Calculate your GST Refund for free with MyGST Refund

- GET Free Consultation for your Notice

- Customized Reply by the Expert

- End to End Support

- PAN India Presence

Book Your Free Consultation

Why you are getting GST Notices?

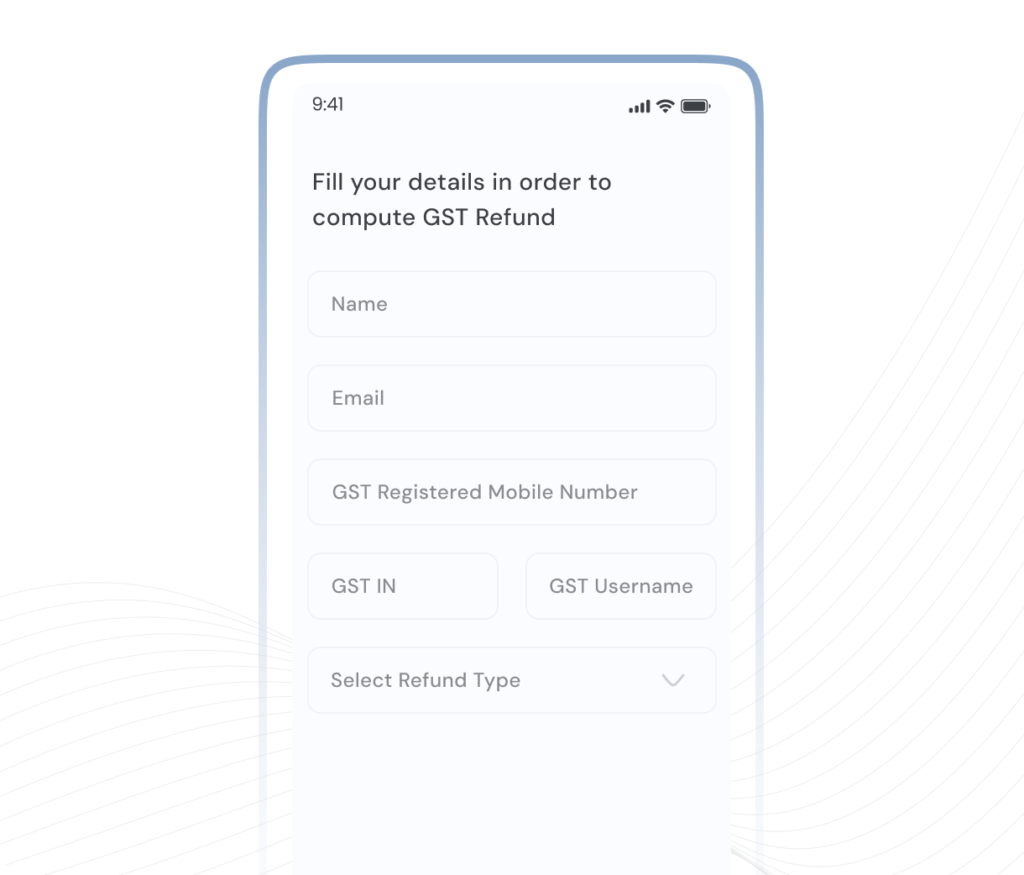

Share your GST Details

Provide your basic GSTIN details to start your calculate journey.

Allow API Access and Verify OTP

Watch the video and allow API access on GST Portal to calculate your refund

Calculate & File Refund

Required documents list will depend on the refund type.

Why we are no. 1 GST Refund Platform

SIX PAIN POINTS OF GST REFUND HANDLED BY US

Timely Refunds

Our efficient processing ensures you receive your refunds on time, keeping your cash flow steady and uninterrupted.

Seamless Applications

We ensure your refund applications are handled with precision, reducing errors and securing the maximum returns for you.

Nationwide Support

Wherever you are in India, our dedicated team is ready to assist, providing expert consultation and support across all regions.

Uniform Attention

From small claims to large refunds, every application is treated with equal care, ensuring you get the attention and results you deserve.

Clear Communication

We keep you updated at every stage, ensuring you have complete clarity and confidence throughout the refund process.

Specialised Expertise

Expert consultation ensures you are well-informed, empowering you to make informed decisions and optimize your GST refunds.

Want to File your refund with MYGST Refund

Move to YOURGST Refund and File your refund hassle free

Streamline Your GST Challenges

Export Refund Calculator

Fast-Track GST Export Refunds to Maximize Your Eligible Returns and Stay Competitive

TCS/TDS Refund Calculator

Ecommerce sellers in India can claim a TCS (Tax Collected at Source) refund from online transactions.

Inverted Duty Refund Calculator

Its Structure Refund provides relief to businesses with higher input tax rates than output tax rates.

Frequently asked questions

Everything you need to know about the product and billing.

Still have questions?

Can t find the answer you’re looking for? Please

chat to our friendly team.

How can I calculate a GST Refund?

What are the different types of GST Refunds?

Why to choose MyGST Refund platform?

Can I claim more than one type of Refund?

Yes, you can claim more than one type of GST Refund, the only thing required is your eligibility, with MyGST Refund platform you can check for the GST Refund quickly